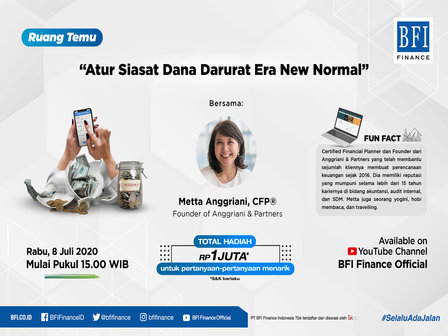

South Tangerang, July 9, 2020 – Social-economic activities have now begun to get lively again gradually under tight health protocols. However, the current New Normal era does not only about adapting to health behaviours. Each person must also reconsider about financial management strategy due to the COVID-19 pandemic, which the World Health Organization is yet to announce the closure. Given the fact, PT BFI Finance Indonesia Tbk (BFI Finance) has embraced communities to promote smart financial management through an online discussion themed “Meeting Room: Managing Emergency Fund Strategy in the New Normal Era” with Metta Anggriani, a certified financial planner who is also the founder of Anggriani & Partners firm.

In a live-stream video on BFI Finance’s official YouTube channel, Metta explains that emergency fund functions as a precaution for emergency conditions that require quite a large amount of ready cash, for instance in case of sickness or sudden job loss. By having an emergency fund, basic necessities can still be fulfilled until conditions return to normal again.

With enough understanding and skills in financial management, people can avoid potential financial problems in the future. A society with adequate financial literacy can also stimulate economic growth in the country. According to a report from the Financial Services Authority (OJK) in 2019, Indonesia’s financial inclusion index reached 76.19 percent, while the financial literacy index was at 38.03 percent. The financial inclusion index is targeted to reach 90 percent by 2024.

Therefore, BFI Finance has concerns and roles to support communities by giving easy access to financing. The New Normal order has also opened opportunities for people to get business capital in an effort to add more income. Credit proposal is now made easier than before. It is accessible anywhere and anytime by clicking the URL Produk BFI FInance's website.

Find new inspiration from “Ruang Temu” (“Meeting Room”) with Metta Anggriani on BFI Finance’s Official YouTube Channel