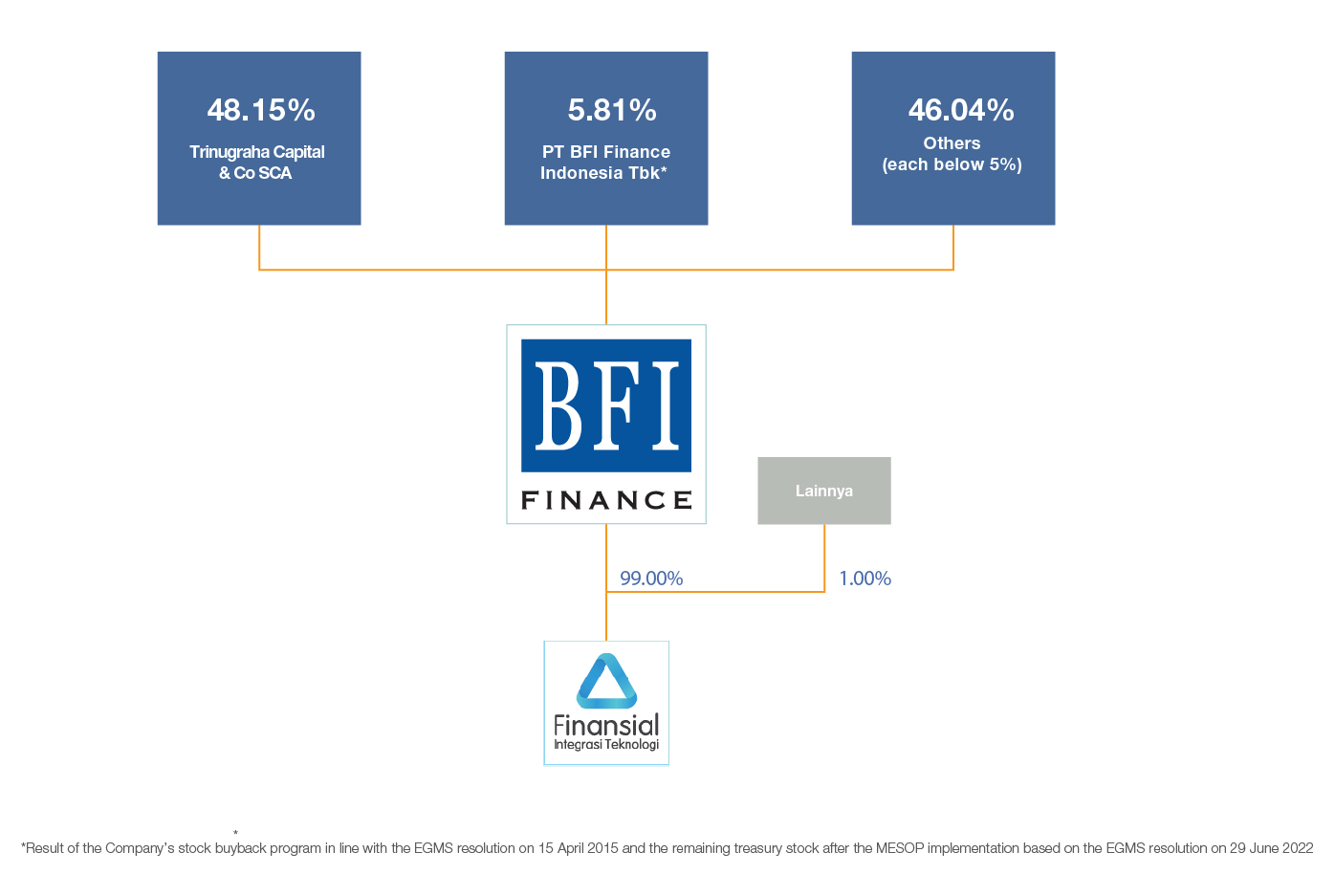

BFI Finance’s corporate structure as at 31 December 2024 is as follows:

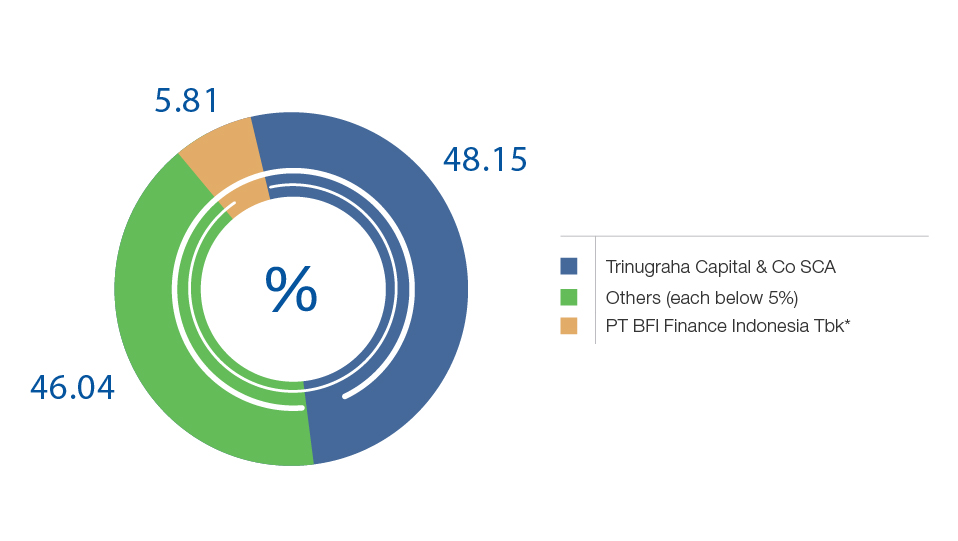

The composition of shares and shareholders of BFI Finance as at 31 December 2024 is as follows:

|

Description |

Price per Share Rp25 |

|||

|

Total Shares |

Face Values (Rp) |

% |

||

|

Authorized Capital |

20,000,000,000 |

500,000,000,000 |

100.00 |

|

|

Issued and Fully Paid-up Capital |

15,967,115,620 |

399,177,890,500 |

79.84 |

|

|

Share Capital in Portofolio |

4,032,884,380 |

100,822,109,500 |

20.16 |

|

|

Shareholders: |

||||

|

Trinugraha Capital & Co SCA |

7,688,125,938 |

192,203,148,450 |

48.15 |

|

|

PT BFI Finance Indonesia Tbk* |

927,732,000 |

23,193,300,000 |

5.81 |

|

| Others (each below 5%) | 7,351,257,682 | 183,781,442,050 | 46.04 | |

|

|

Total | 15.967.115.620 | 399.177.890.500 | 100,00 |

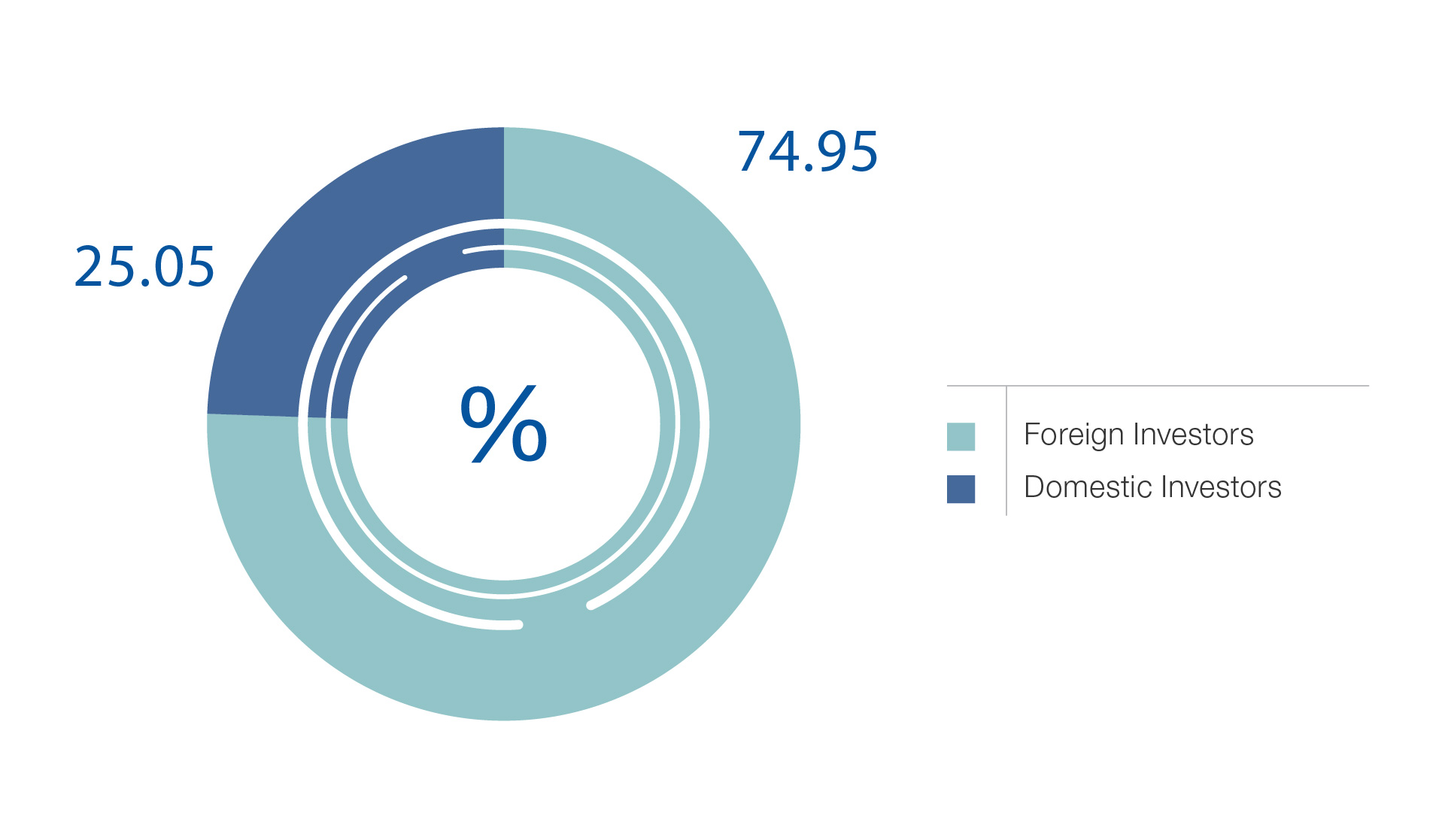

Overall, foreign investors constitute 74.95% of BFI Finance’s shareholders, while local investors constitute the remaining percentage.

Overall, foreign investors constitute 74.95% of BFI Finance’s shareholders, while local investors constitute the remaining percentage.

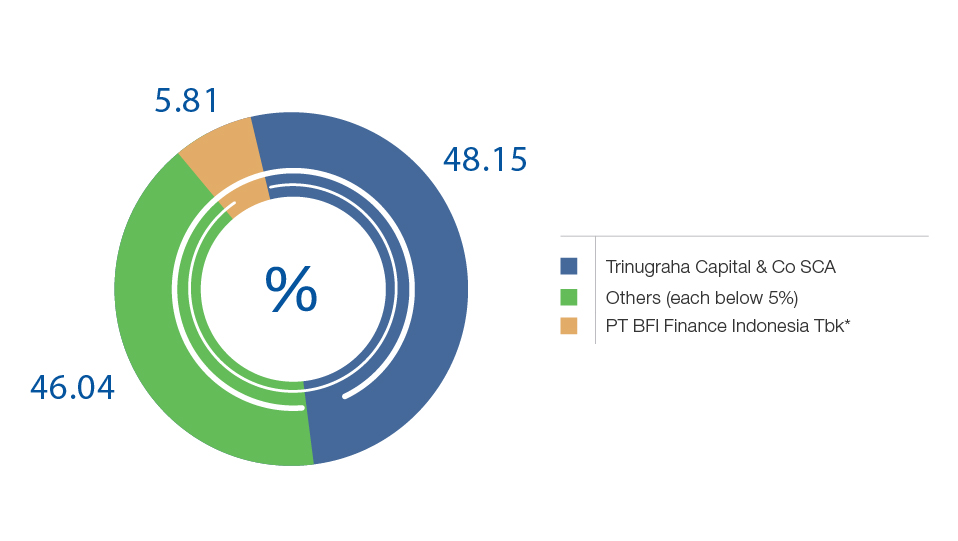

Regarding BFI Finance’s share ownership, there are two institutions that each holds more than 5% of shares, namely Trinugraha Capital & Co SCA (48.15%) and PT BFI Finance Indonesia Tbk (5.81%).

Regarding BFI Finance’s share ownership, there are two institutions that each holds more than 5% of shares, namely Trinugraha Capital & Co SCA (48.15%) and PT BFI Finance Indonesia Tbk (5.81%).

You are still on applying process